Unfortunately, we’ll all experience an economic downturn during our lifetime.. But history has revealed quite a few industries that are recession-proof. These businesses thrive when economies are booming, but they also hold up when things go sideways.

If you’ve been looking for recession-proof business ideas to help you stay afloat in all kinds of economic conditions, you’ve come to the right place.

Custom Products Businesses Thrive During Recessions

Economic downturns shouldn’t have you running scared. If a recession hits, you don’t want to be hiding your money in a mattress or setting aside your dreams of owning your own recession-proof small business.

Recession-proof businesses such as cleaning services, financial advisors, and grocery stores continue serving customers and turning profits, even amid an economic recession. Starting or running one of these businesses is about shifting money and investing in an endeavor that experiences high demand in tough economic times.

Warren Buffett is one of the wealthiest and most successful investors in history. Investing just $1,000 in his Berkshire Hathaway shares during its IPO in 1964 would have you retiring today with a cool $26.7 million.

As Buffett said, “Be greedy when others are fearful.” Others took their investment dollars off the table during challenging times, but Buffet was busy seizing opportunities to grow and save money.. Businesses that are recession proof are built by people who are fear-proof; they might feel the fear, but they don’t let it stop them.

Invest in Yourself and Your Ambitions

Putting faith in yourself and those around you is one of the best investments you can make. People often think that huge corporations are mystical entities that exist independently of people.

But that’s not the case.

A corporation, in its most basic form, is a document registered with the government that describes the ownership and structure of a business. That ownership always points to a person or group of people who believe in it.

Every big brand name started with someone or a group of people who were ready to invest in themselves rather than work for someone else, especially during an economic downturn.

Recession-proof businesses have a proven track record of generating revenue, even in a down economy. Since you’ll be in this for the long haul, why not choose an industry that can succeed regardless of how the rest of the economy is doing?

Examples of Recession-Proof Businesses

Even in tough times, consumers continue spending. Here are some examples of recession-resistant businesses that generally do well during down economies:

Movies / Home Movies & TV

Beer, Wine and Liquor

Tattoo Parlors

Candy

Custom T-Shirts & Custom Products

Partner with the Right Vendors

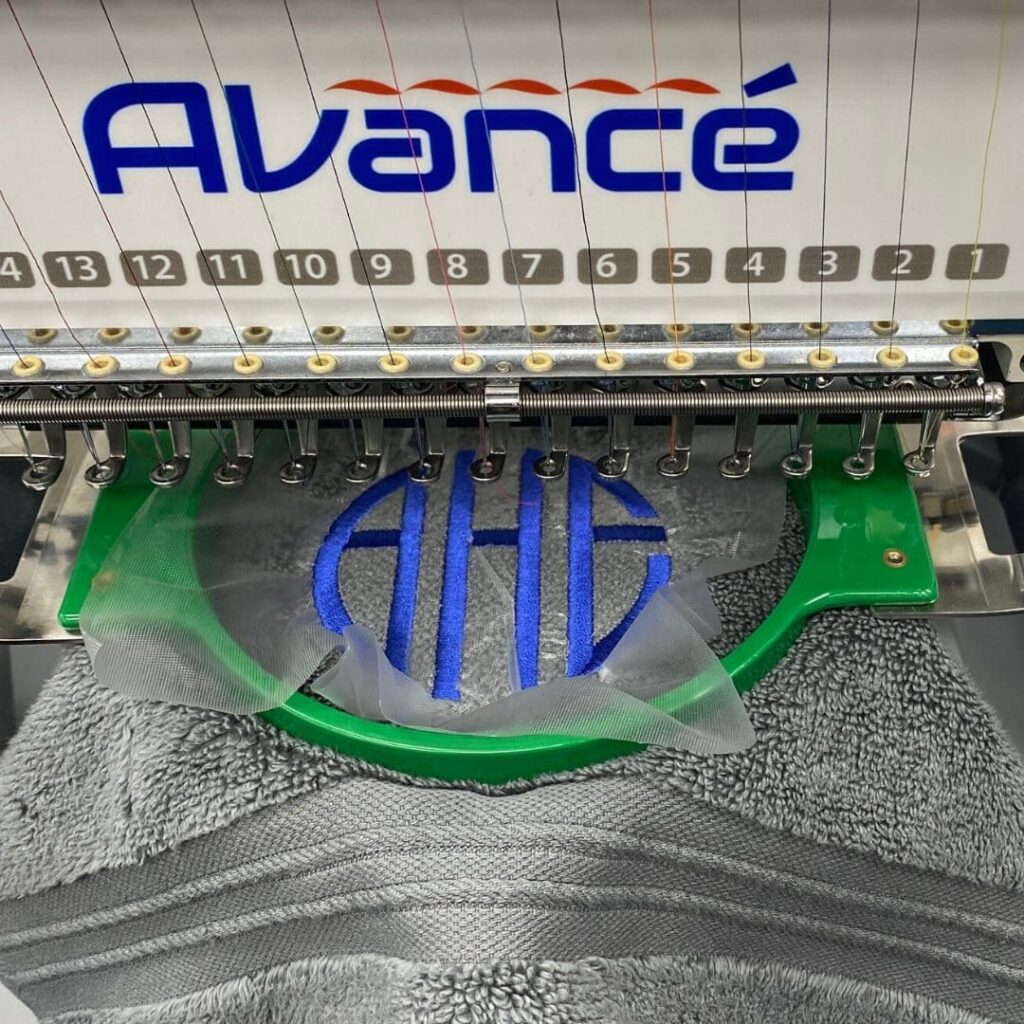

Custom t-shirt and embroidery businesses do very well, even during downtimes. There are plenty of opportunities, and the markets are large enough to allow new small business owners to find a foothold Some examples of what you can achieve and who you can work with:

- Developing your own brand

- Bling Garments

- Working with Schools

- Sports Teams

- Corporate Identification

- Custom T-shirt Printing

- Embroidery

- Specialty Printing

It turns out that custom apparel items will profit somewhere between $12 and $20 per shirt. And very often you’re selling dozens of shirts or hats per Job.

As a side-hustle, an embroidery or printing shop will do a few key things. First, it will allow you to make extra money in the short term. As a result, you can stash some much-needed cash in your essential emergency fund.

Diversify Your Assets

Owning your own business will reduce your financial risk by having multiple streams of income. If all your eggs are in one basket (the salary your day job provides), you’re more at risk than if you have extra income.

How nice will it feel to know you have another way to cover your mortgage payment if the need arises? Having more than one way you make money means that if one is reduced or goes away, you have another source of income to pick up the slack.

Another Silver Lining? -Tax breaks

Some people learn a secret when they’re young, especially if they’re young business owners. But it’s never too late to put it into practice and reap the rewards. The secret? You can write off enough unique business expenses to easily reduce your business’s overall cost.

This is what big companies do. They invest their profits and enjoy sizable tax breaks for capital investments.

Here are a few expenses that many side hustlers take as a tax deduction. Please note: We are not accountants, and this is not tax advice. You should always consult a professional regarding the following:

- Mileage for delivering products and prospecting for new business.

- In home offices and dedicated production spaces. If you run your embroidery machine in a bedroom or home office for your business, you may be able to deduct part of your mortgage or rent.

- Entertainment expenses for clients.

- Health Insurance for yourself and your spouse.

- Business Related Trips

- Education Expenses and Trade / Craft Shows

Any expense that helps you advertise or goes into the cost of doing business could be deducted. Plus, there are hidden gems in the tax code that can make starting a t-shirt business a winner even before you sell your first shirt. This is especially true if you were going to have a big tax bill this year and can instead use that tax break to invest in your future.

Interested in Financing Custom Apparel Equipment?

ColDesi has worked with Adia Capital as a trusted partner to both provide financing opportunities for our customers, but also to deliver sound advice about starting and operating a small business.

Finance Rates During A Slow Economy

Any licensed financial advisor will tell you: there are two primary ways to earn money on your money: by lending or borrowing.

Lenders earn by trading their capital for interest. When you deposit money in a bank, the bank pays you a small interest rate and then turns around and lends your money to someone else, often at a higher rate. In fact, for every physical dollar in circulation, as many as six or seven virtual dollars may be created through repeated lending. That’s how wealth is generated in the lending economy. If you have a bank account, you’re already part of it.

Borrowers, on the other hand, aim to earn more than the cost of borrowing. They invest the lender’s capital into something that generates greater returns, like a business, trade skill, or product they can sell. This is how entrepreneurs leverage financing to get ahead, especially in recession-proof industries.

For example, in the custom apparel world, investing in the right equipment (like a t-shirt printer or embroidery machine) using today’s low financing rates can accelerate your growth, without draining your savings. You’re using someone else’s money to build a business, earn income, and scale smarter.

In a slow economy, this strategic borrowing can be a game-changer. It allows you to take advantage of economic conditions and position yourself as a recession-proof small business that thrives regardless of the market.

Investing in Recession-Resistant Equipment

Today, financing rates are among the lowest we’ve seen in the history of small business side hustles. That means your monthly budget goes further, allowing you to invest in revenue-generating equipment without breaking the bank.

For example, when it comes to launching a recession-proof small business like a custom t-shirt or embroidery shop, financing your equipment could cost far less than you might think:

- A $10,000 DigitalHeat FX T-Shirt Transfer Printer Bundle: $210–$230/month

- The DigitalHeat FX 9541 System: $308/month

- The G4 DTG Printer: Around $100 more per month

To estimate monthly payments, many business owners use a simple finance “factor” of .021 to .023. So for every $10,000 financed, you can expect to pay about $210–$230 per month.

These low payments are especially attractive when you consider potential profit:

- If your custom t-shirt business earns $10–$20 in profit per shirt, your break-even point is just 20 to 50 shirts per month, a goal many small business owners reach in their first 30 days.

Even better? Because equipment is more accessible, entrepreneurs are now launching with a more complete setup. Rather than starting small and upgrading later, they’re adding embroidery machines, t-shirt printers, or content creation tools from day one. Additional equipment helps them serve more customers across different recession-proof industries like healthcare, cleaning services, and home repair.

In tough economic times, the ability to generate income from essential services or high-demand products is what makes a business resilient. With flexible financing and growing demand for custom goods, starting a service-based or product-based business right now isn’t just doable, it’s incredibly smart.

More entrepreneurs are increasing their chances of success by bundling two or more systems together.

Take the Stitch-N-Print system, for example. It’s a powerful combination of embroidery and t-shirt transfer capabilities. Or consider the popular pairing of the OKI 8432WT transfer printer with the SpangleElite bling machine.

Why does it matter? Because your customers won’t all want the same thing. Some prefer embroidery, others want printed tees, and many need both. Custom apparel buyers often order a mix of styles, especially for businesses, teams, or events.

By expanding your capabilities, you can say “yes” to more orders, serve a wider range of clients, and maximize every opportunity that comes your way.

Invest in yourself. Be recession-proof. Make the call.