Episode 140: Financial Questions Answered

Posted On: Oct 6, 2020

Podcast: Play in new window | Download

YOU WILL LEARN

- What are business loan options for small businesses

- When to use credit and cash for large purchases

- How to plan for retirement

RESOURCES & LINKS

Episode 140: Financial Questions Answered

This podcast is brought to you by ColDesi

In Episode 140 of the CAS Podcast, we bring in financial advisor Jason Fuchs of SagePath Financial Advisors to answer the real money questions that custom business owners face every day. From choosing how to pay for equipment to planning for retirement, this episode gives you clear, practical advice for managing the personal side of running a custom business.

Whether you’re in embroidery, t-shirt printing, signage, or promotional products, your financial foundation matters—and this episode gives you a chance to get it right.

🎙 Guest: Jason Fuchs, SagePath Financial Advisors

What Listeners Wanted to Know

This episode answers the most frequently asked financial questions from apparel and customization business owners:

💰 Small Business Loan Options

● When should you pay cash?

● When is it smarter to borrow?

● When is it best to wait?

Jason explains how to weigh the cost of borrowing against opportunity cost—helping you understand when debt can fuel growth and when it can become a trap.

💳 Credit vs. Cash for Equipment

● Credit offers flexibility, but can carry long-term interest.

● Cash avoids debt but can drain your operating funds.

Jason outlines how to balance liquidity, build creditworthiness, and decide which method fits your current business stage.

🏗 Getting Set Up Right From the Start

Many business owners jump in without setting up proper financial systems—Jason explains what you should do at the beginning:

● Open separate business accounts

● Establish clean accounting systems

● Document all purchases and expenses

● Understand your tax obligations

This is essential for making your business finance-friendly when you’re ready to borrow or invest.

💼 Planning for Retirement as a Small Business Owner

If you’re self-employed, you are your own retirement plan. Jason covers:

● Simple IRA vs. SEP IRA vs. Solo 401(k)

● When to start (spoiler: now!)

● How even small contributions make a big difference over time

Too many entrepreneurs delay retirement planning thinking they’ll “get to it later.” This episode gives you the motivation and tools to start today.

📚 Resources and Recommendations

🎧 Podcast: Dad Cents by Jason Fuchs – bite-sized personal finance advice for entrepreneurs and families.

📖 Article: ColDesi Financing Options – learn how to get the right funding for your business growth.

🎧 Also Listen To: CAS Podcast Episode 137 – Marketing Playbook – pair your financial plan with a winning sales and marketing strategy.

Final Takeaway

Running a successful customization business isn’t just about what you make—it’s about how you manage what you earn. Financial clarity and planning aren’t just for big corporations—they’re essential for solo entrepreneurs and growing shops too.

With the right tools, advisors, and habits, you can fund growth, protect your business, and build a future that’s both profitable and secure.

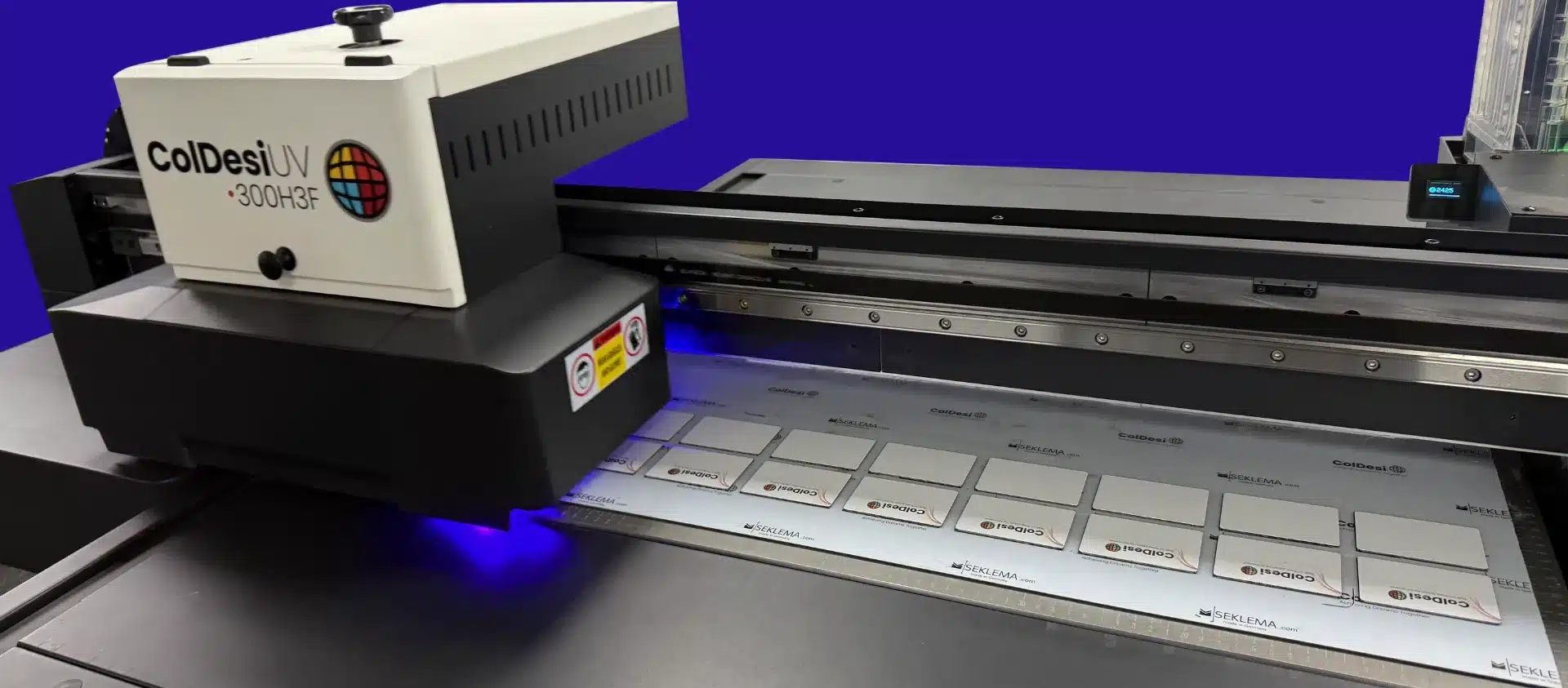

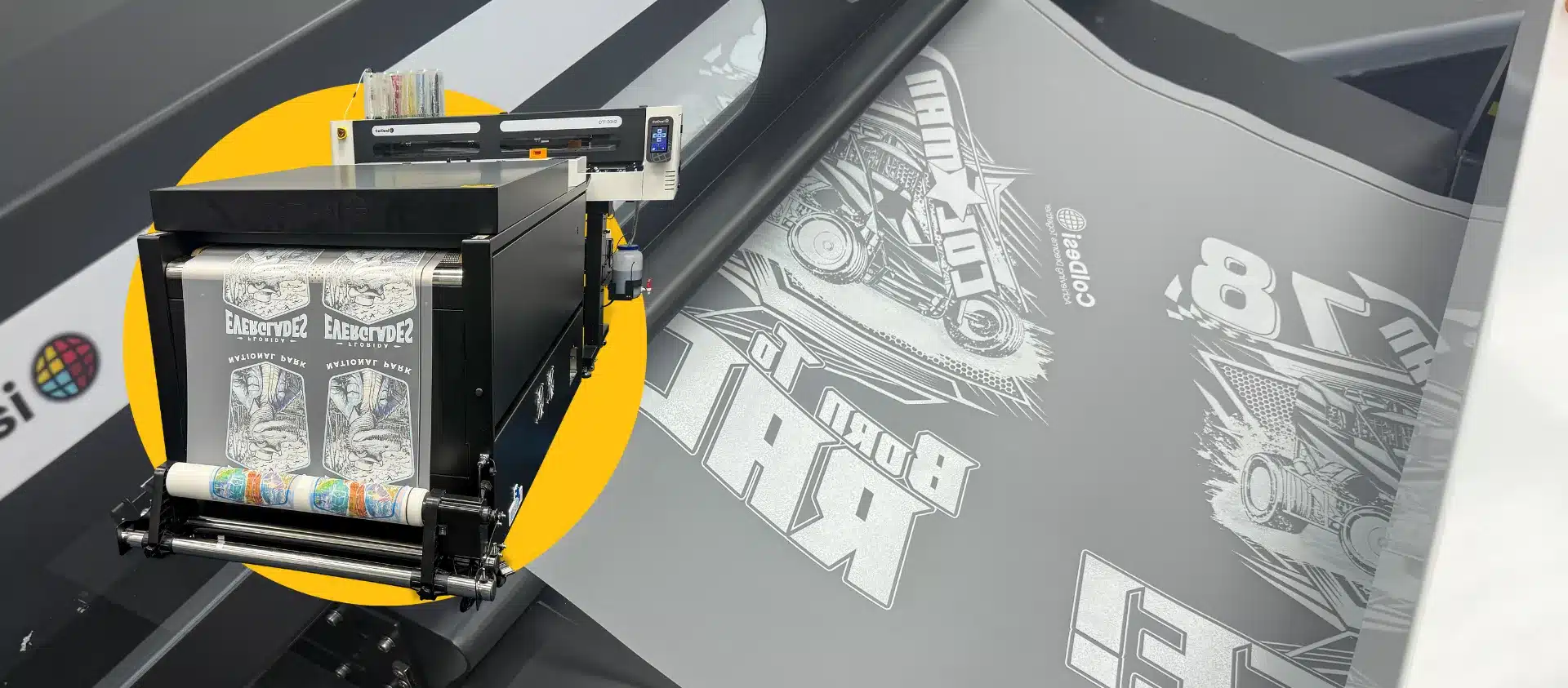

About ColDesi

ColDesi is a leading provider of custom apparel and digital printing solutions, empowering businesses with innovative equipment and unmatched support.

With decades of industry experience, ColDesi offers a full range of professional-grade solutions, along with comprehensive training and customer service.

Their mission is to help entrepreneurs and established brands grow through cutting-edge technology and expert guidance.

Watch Us Recorded Live on YouTube

Heard Something on the Podcast That Piqued Your Interest?

Fill out the form and we’ll have one of our product experts reach out to help you sort through the best tools and gear for your goals!