Here’s your road map to looking at your business the way a seller and buyer would, rather than a business owner. This is not about selling your business. It’s about revealing where your business may need some help.

Maybe you just feel like you’re in a business rut.

Perhaps you are showing up to WORK every day, and it’s feeling more like a JOB? -Instead of the exciting venture, you originally started.

Is it beginning to seem like there’s some factor that’s conspiring to limit your business destiny?

Do you recognize any of these?

- New Competition

- New Rules, Laws or Taxes

- Pandemic

- Bad local economy

- Loss of BIG customers

- Unknown Political Future

Change Your Perspective

Just maybe you’re working as hard as you can. Your customers love you and love your business, but you can’t seem to make it to that elusive “next level” of sales. The next rung on the income ladder seems just out of reach, and you don’t know why.

The best way to evaluate your business and find what’s holding you back is to examine your company from a Buyer’s and Seller’s perspective. Throw away the emotion for a while and think outside the box for a minute.

This article will walk you through how to look at your business with fresh eyes.

Gathering the information on your business like you’re going to SELL it.

And then looking at your business like you were BUYING it, instead of running it.

This kind of “outside” perspective can reveal both personal and professional areas for potential growth and lead to a better business.

The basic premise is that everything you do to make your business more attractive to a Buyer will be better for your business!

Preparing to Sell your Custom T-Shirt Business

The first step is to imagine you’re preparing to “sell” your business. That’s because to evaluate where your business is and how it’s doing, you must be able to see it as others see it.

Take a day or so to put together materials about your business. Documents and Reports that a Bank or Broker or business flipper would ask for. Then assemble a package of things that YOU would want as a Buyer yourself.

Valuing your Business – What You Need and What They'll Ask For

This topic is a real rabbit hole you could get lost down if you’re not careful. But it’s essential you gather this information and understand what it means.

Here are some simple boxes to check off you can use. However, make sure to do your research on anything you have questions about. You can start here with this Wiki about Financial Statements.

What are those? An income statement, cash flow report, and balance sheet.

What cash in and out look like every month, and what you own vs. what you owe.

Especially if you’re a sole proprietor. But even if not – do that because of what we’ll discuss below.

What does your company own, and what is that worth? Equipment, inventory, those are easy – the value of any contracts is the tough part.

- Try and find other companies in your niche or area that have sold recently to get an idea of what it might be worth.

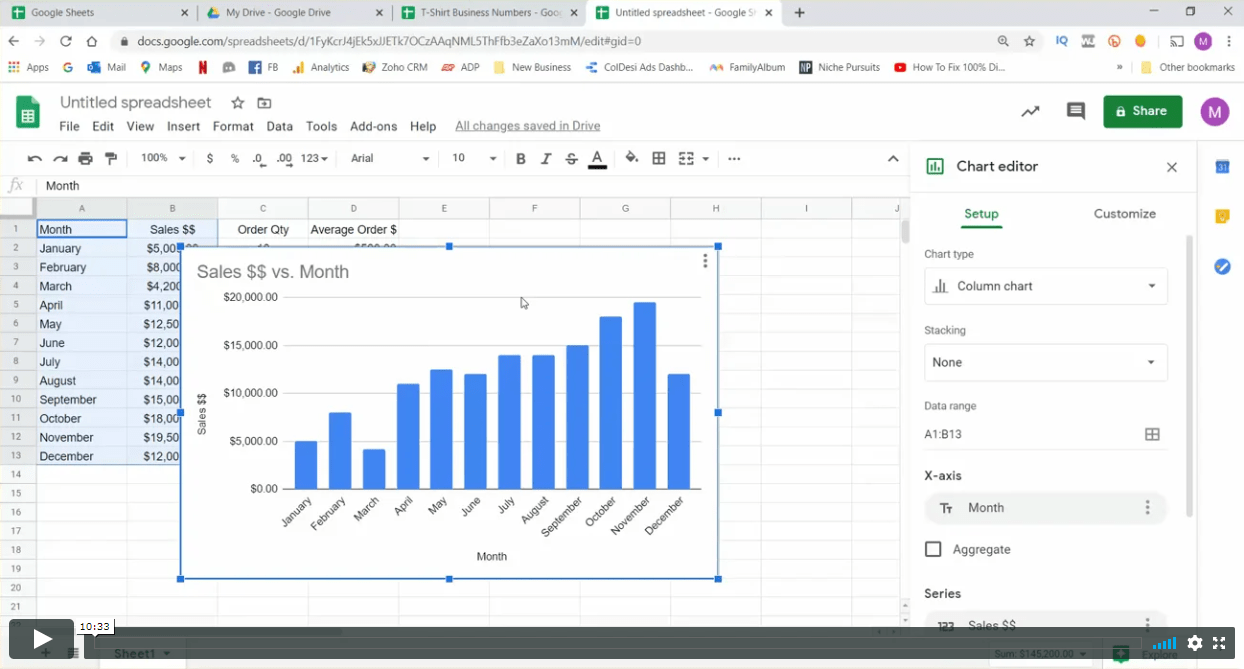

Learn the Lessons That YOUR Data is Teaching You

The process of seeing your business like this should be enlightening. It may turn out that this is the very first time that you have ever considered putting all this information together. Don’t be afraid, lots of people have simply started their business without making any provisions about how to track their results.

But I’ll bet by now you’re noticing some interesting trends in your month by month and year over year data.

Perhaps certain products you sell are doing better than you had imagined. -Or, maybe it’s time to consider letting go of some product lines that are consistently losing you money.

It’s perfectly OK to be constantly changing up your business model to match what is selling and bringing you the most profit each month. Even if you have built your identity around one type of product, be willing to open your mind and move into other niche markets if you need it.

Finding Turnaround Ammunition in the Selling Prep Process

If you do this exercise like you’re genuinely preparing to sell your business, you’re also going to find areas that need expansion. You’re going to want to be ready to pounce as you discover new opportunities for your business.

Some of you have found out that your business makes NO MONEY. When you do your financials, or better yet have them done by a pro, it could turn out that you’re working your butt off just to pay your mortgage. That’s called bootstrapping. It’s hard to swallow, but with constant improvement and synergy, you WILL grow.

Others may be shocked at the idea that on paper, you’ve made a LOT of money, but as you pick through your bank accounts, you can’t find any evidence of that. It still feels like your struggling.

You may have been caught off guard by how much inventory you have. OR how much or little you’ve invested in reliable equipment.

Now that you have your BASIC seller situation worked out – let’s talk about what you would want if you were a BUYER of a custom apparel or sign business.

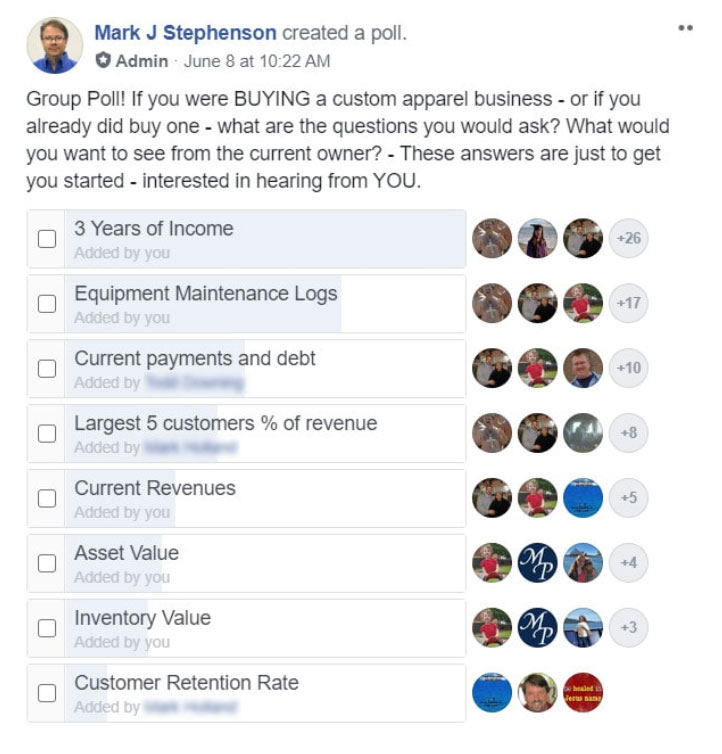

What Business BUYERS Want

You can research all the many ways that someone might value your business on a technical basis. The first thing an experienced business owner might ask is what your EBITA is (earnings before interest, taxes, and amortization)?

(EBITA) is a measure of company profits and potential. It is helpful when you compare your business to others in the same industry of the same size. It can also provide a more accurate view of the company’s real performance over time.

Another similar measure adds depreciation to the list of factors to be eliminated from the earnings total. That is earnings before interest, taxes, depreciation, and amortization (EBITDA). With a “D” for the added depreciation.

What is Your Business Worth? Really?

What are you asking as a multiple of earnings? And what you accomplished in the previous section of this article will help you with that.

But the average person that wants to take a shortcut to success in starting their own custom t-shirt business or sign business, or even staring an awards or promotional products shop, isn’t going to ask those questions.

The average buyer wants to know how much money you’re making and if you can prove it.

They’ll want to see your “book of business.”

- How many customers do you have?

- How many new customers every month?

- How many returning customers?

- Who are your BIGGEST customers, and what percentage of sales are they?

And they’ll want to know how your business operates.

They’ll want to feel like there’s a manual written. So that on Day one of THEIR new business, they will know exactly where things are and what to do. Invest some time to put that together.

Now, imagine you are BUYING a Custom T-Shirt Business

Pretend you were looking into two different custom t-shirt shops to purchase, trying to decide which one is going to be your new financial home.

One of them sends you a QuickBooks file and some tax returns. Maybe a stack of receipts.

The other gives you…

- Financials

- A line chart for NEW CUSTOMER growth over time.

- A list of best-selling products

- Potential ongoing revenues from the best and biggest customers.

- Maybe even more importantly – they give you a Manual on how their business operates.

Imagine if YOU had a document in your hands right now that was something like this:

THIS IS HOW TO RUN THIS BUSINESS

Here is everything you need to know to run this customer t-shirt business on a daily, weekly, monthly, and annual basis. Even the stuff I don’t want to look too closely at.

With Chapters like:

Chapter 1

Here's how we train our employees and GET trained on equipment

Chapter 2

This is how we answer the phone

Chapter 3

This is how we take orders

Chapter 4

This is how we get an order from when it's placed, to when it's delivered

Chapter 5

This is how we keep track of our customers

Chapter 6

Here's where and how we market our products and the schedule we use to do that

Chapter 7

All the information on our equipment including dates of purchase, warranty information, how to get help, maintenance schedules and logs

Chapter 8

These are our vendors, their contact information and their pricing

Chapter 9

Our daily start-up procedures and our regular shut down procedures

Chapter 10

Here's what I would do next if I were buying this business

Imagine what YOU will learn about your business from reading your manual!

Finding Opportunities By Looking At Your Business Like A BUYER

Some things you just might find:

When you’re writing Chapter 1 about Training, you may realize that your teams need Training, and that might explain why it takes longer to complete jobs than it should. If so, reach out to an equipment vendor you trust, with a proven track record of excellent service and reviews.

You may learn there’s real confusion over what happens AFTER you take an order—uncertainty in your customer’s minds or your employees. In today’s instant gratification culture, you might need to invest in some tools to help you better communicate at each phase of the job.

Everyone answers the phone differently, so every caller gets a different impression of who your company is.

You may find that you don’t keep good track of your customers – only your orders. So, maybe they never hear from you unless it’s to pick up a job? Can you spare an hour each week to rotate through your customers to catch up?

You’ll likely have a “how you market your business” chapter that’s too short, -with fits and starts in different media, varying budgets, and more. Regardless, whatever you learn will only help you.

If you're already IN business and want to get online, on-demand ordering, order management and production systems check out ColDesi OnDemand.

Turning Around a Custom Products Business

Did you know that there are people that specialize in rehabbing businesses? They’re not serial entrepreneurs. But more like business flippers.

A business flipper looks for businesses, maybe just like yours.

They’re looking for ones with a few years in business that either once made money or are cash-flow positive now.

They look for business owners that have neglected or are unaware of digital marketing, operational efficiencies, financing options. They know the gains that can be made by taking a business like that and making profits on the inevitable growth—venture capital appreciation.

They are looking for businesses that are not more profitable, bigger, or expanding because the owner or management either lacks the knowledge of what to do to make it better or the will to implement those changes.

And they’re not paying what you and I would consider a lot of money for those businesses either. Because maybe you’re just now learning how much your business can be worth with the right partners and the right tools?

Seize YOUR opportunity now to turn around your OWN business! You can do it.