Financing Options and Section 179

Financing and Cash Flow are some of the most important aspects of a successful business, and are the subject of some vital decisions for new and small business owners in any industry. The custom apparel, embroidery and custom t shirt businesses are no exception.

The advantages of leasing in particular apply especially to apparel decorating equipment like embroidery machines, direct to garment printers and rhinestone machines because cash flow is so important when you’re first starting out.

Episode 45 – Equipment Leasing with John Sullivant

Get Pre-Approved and Expert Advice at Adia Capital

ColDesi has worked with Adia Capital as a trusted partner to both provide financing opportunities for our customers, but also to deliver sound advice about starting and operating a small business.

Cash Flow vs Cash Purchase

One school of thought for starting a small business is to start debt free.

The advantage of a debt free business is that you have the comfort of not having to worry about making a monthly payment.

If you have a bad month or it takes you some time to generate sales you don’t have that payment to fit into your budget.

And once you DO start selling, the money you earn goes right to your bottom line.

But the cons of the debt free approach to starting an embroidery business, a promotional products store, or a custom t shirt business outweigh the pros. That’s why many ColDesi customers Finance or Lease equipment instead.

The 3 PROS to Financing

#1 – Jumpstart Your Business with Better Systems

Better equipment = profitability.

A lot of people lease a truck instead of buying so they can afford a bigger or better one.

Getting equipment works the same way. You can afford better machines because you don’t need all that cash. B

ut in this case, affording better equipment means that you can actually make more money!

Let’s say that you can afford to only buy 1 single head embroidery machine in cash. You will likely be able to afford to lease 2 or more machines and use the cash as a back up to bolster you against slow months.

With two embroidery machines you can literally double the about of money you can make in an hour because you can produce twice as many hats, polos, etc.

So you get the advantage of having cash in the bank for safety AND doubling your potential for profit. The same goes for DTG Printers, rhinestones machines and spangle equipment.

#2 – Avoid Big Order Failure

Big Orders can kill a small business.

It happens all the time.

Sounds counter intuitive right? But when you get a very large order for the first time you spend a lot of your own money up front.

You have to purchase the blank shirts and pay for those up front. They will take some time to arrive. Money out of pocket.

Then you will actually DO the job, which may take weeks if you bought a single machine and it’s a very large order.

And then there’s delivery time.

If the order’s big enough you probably offered terms, so you’ll have to wait for payment.

A public school or large company that payment may not come in for 30 to 60 days. So your cash is tied up for that entire time.

What if you get ANOTHER order while all this is going on? Or your car has issues? Or your equipment needs repair?

If you’re leasing you’ll still have cash reserves to survive your success!

#3 – Save Money on Taxes

The reason that really big companies lease equipment is often all about taxes.

Adia Capital will tell you all about this. In the end you will work with your accountant, but the savings are definitely there.

You’re going to net more money at the end of the year because you leased. AND you’ll still have that cash you would have spent in the bank.

And speaking of Taxes…

What is Section 179?

Section179 is a part of the US Tax code relating to equipment purchases and how they impact the amount of money a business will pay in taxes.

Also called “Protecting Americans from Tax Hikes Act of 2015” (PATH Act), it sets a tax deduction limit in the current year to $500,000*.

Section 179 can provide you with significant tax relief for this tax year, but equipment and software like an embroidery machine, direct to garment printer, uv printer or any of the equipment ColDesi provides.

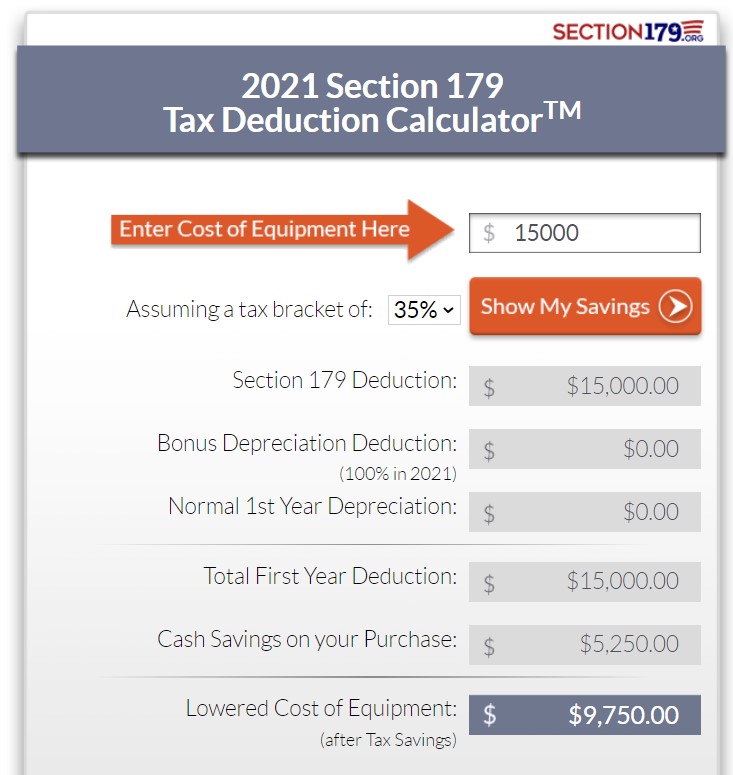

This image is from a popular SAMPLE Section 179 tax savings estimate calculator. As you can see, your potential savings is HUGE!

You can find specific information and return on investment information for Leasing an Embroidery Machine on our Avancé website and if you’re interested in Direct to Garment Printers on Leasing a Direct to Garment Printer page. But the basics are going to be the same no matter what you buy.

*check with your accountant for current year changes.

Your Next Step

You have a few choices on how to move forward:

- Contact Us Now – you can chat with an Account Manager in the lower right corner of the website, call us at 877-793-3278 or fill out the form below. We’re ready to help!

- Contact Adia Capital directly to talk financing, leasing and what you need to do to get started at http://www.adiacapital.com